The SBI share price today is a key indicator of investor sentiment and market direction.

Understanding its movement provides insights into economic trends, policy impacts, and banking sector performance.

Investors need to stay informed about real-time updates, expert analysis, and future projections to make confident and well-timed investment decisions.

Introduction to SBI Share Price and Its Market Influence

The State Bank of India (SBI) holds a dominant position in the Indian banking landscape, making its share price an important indicator of the sector’s health.

The SBI share price reflects not just the bank’s internal performance but also the confidence investors place in the Indian economy.

Due to its size, reach, and market capitalization, SBI acts as a bellwether for the banking industry.

Its stock is a favorite among institutional investors and retail traders alike, often influencing trends in the broader financial market.

Movements in the SBI share price can also affect benchmarks like the Nifty Bank and Sensex.

Investors closely monitor SBI due to its stability, government backing, and wide branch network.

The stock’s performance is also tied to interest rate decisions, credit growth, and policy changes.

In short, the SBI share price serves as both a barometer and a driver of market sentiment in India.

SBI Share Price Today: Live Market Updates

Monitoring the live updates of the SBI share price is essential for traders and long-term investors alike.

As markets open each day, various factors—including pre-market cues, global events, and domestic news—begin to influence the stock’s movement.

Real-time updates offer insights into short-term trends and intraday volatility.

Investors use platforms like NSE, BSE, and financial apps to keep track of every fluctuation.

Today, SBI is not just a traditional bank but a digital-first institution, and market participants factor in tech innovations and quarterly earnings when analyzing the SBI share price.

Additionally, news such as changes in interest rates, loan book performance, and NPAs can shift investor sentiment throughout the day.

For intraday traders, this live data helps in making fast decisions, while long-term investors use it to identify ideal entry or exit points.

Staying informed about the SBI share price today is key to making timely and informed investment decisions.

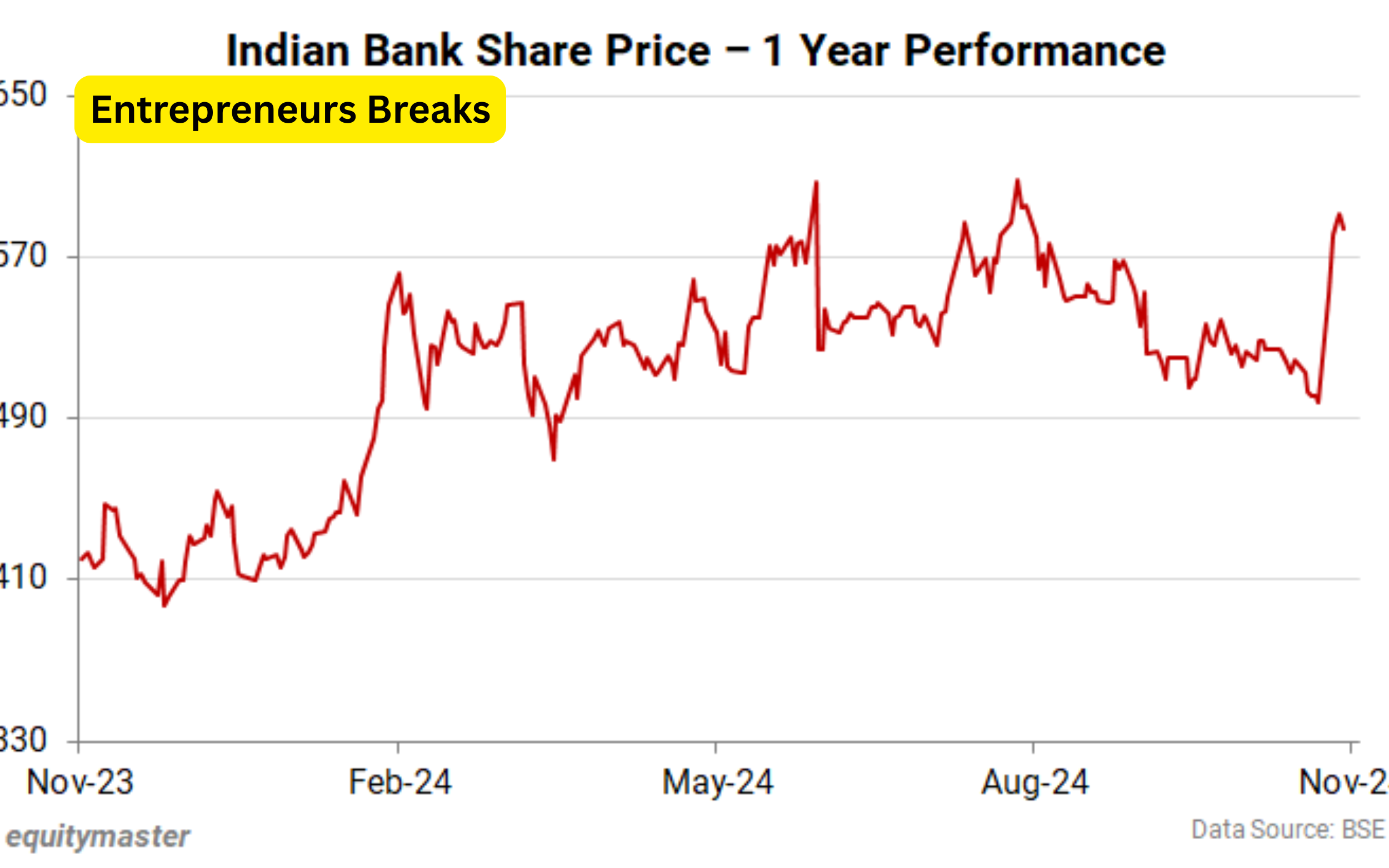

Historical Performance of SBI Share Price Over the Years

The historical trajectory of the SBI share price tells a compelling story of resilience, growth, and transformation.

From its modest beginnings in the early days of stock market listing to becoming a blue-chip giant, SBI’s share has seen many ups and downs.

Past data shows that the stock has responded to economic reforms, interest rate cycles, and internal restructuring.

The 2008 financial crisis, for instance, saw a dip in the SBI share price, but it rebounded strongly as the economy recovered.

The COVID-19 pandemic caused a temporary slump, but the stock again surged with renewed investor confidence in 2021 and beyond.

Long-term charts reveal that despite short-term volatility, SBI has consistently delivered value to its shareholders.

Understanding the historical performance of SBI share price helps investors recognize patterns and cycles.

This context is crucial for assessing its current valuation and future growth potential based on past performance.

Key Factors Influencing SBI Share Price Movements

Several internal and external factors collectively influence the movement of SBI share price.

Internally, the bank’s quarterly financial results, asset quality, loan growth, and profitability metrics play a direct role.

Investors pay close attention to net interest margin (NIM), non-performing assets (NPAs), and overall return on equity.

Externally, interest rate policies set by the Reserve Bank of India (RBI), inflation data, GDP growth, and global economic trends all impact investor sentiment.

Changes in government regulations or fiscal policy announcements can also create fluctuations. Moreover, any major acquisitions, mergers, or changes in leadership at SBI often lead to movement in the SBI share price.

The global banking landscape, especially actions by the US Federal Reserve, can cause ripple effects.

As a state-owned entity, political stability and government initiatives targeting public sector banks also influence investor decisions.

A clear understanding of these factors helps forecast future trends in SBI share price

How Global and Domestic Events Affect SBI Share Price

The SBI share price is highly sensitive to both global and domestic events.

On the global front, developments such as crude oil prices, US Federal Reserve interest rate decisions, and geopolitical tensions can impact investor confidence, indirectly affecting Indian markets and banking stocks.

Domestically, policies announced in the Union Budget, RBI monetary policy decisions, and macroeconomic indicators like inflation and GDP growth can cause fluctuations.

For example, during the COVID-19 pandemic, the uncertainty around economic growth caused a sharp decline in banking stocks, including SBI.

Conversely, strong domestic recovery and digital banking reforms helped boost the SBI share price.

Events like elections also play a role, as markets react to the expected fiscal direction.

Similarly, government recapitalization of public sector banks often improves investor sentiment.

For serious investors, keeping track of such developments is essential to anticipate shifts in the SBI share price and make informed financial decisions.

Expert Analysis and Predictions for SBI Share Price

Market analysts regularly provide expert opinions on the future direction of SBI share price based on data-driven forecasts.

These predictions take into account technical indicators, such as moving averages and RSI, as well as fundamental factors like earnings growth and book value.

Analysts from top brokerage firms often revise their target prices after quarterly earnings, which can influence short-term stock movements.

Many experts consider SBI a strong long-term bet due to its leadership in the banking sector and digital transformation initiatives.

Their projections suggest that if India continues on its growth path, the SBI share price could see consistent appreciation.

However, analysts also caution investors to be mindful of challenges such as rising NPAs or slow credit demand.

These expert analyses are useful tools for both individual and institutional investors seeking to make calculated decisions.

Overall, expert predictions on SBI share price offer insights grounded in rigorous financial analysis.

SBI Share Price vs Competitor Banks: A Comparative Look

When comparing SBI share price with that of its private and public sector peers, several interesting patterns emerge.

SBI stands out for its sheer scale, customer base, and asset value. However, private banks like HDFC Bank, ICICI Bank, and Axis Bank often trade at higher valuations due to their efficiency ratios and lower NPAs.

Despite this, SBI remains competitive with strong earnings, dividend payouts, and aggressive digital adoption.

While HDFC and ICICI show steady performance in the stock market, SBI’s larger exposure to rural and government-linked lending adds a different risk-reward dynamic.

During bull markets, the SBI share price often sees sharper rallies, benefiting from government support and sector-wide optimism.

In bearish phases, it may underperform due to policy uncertainties or public sector inefficiencies.

Comparing SBI share price to competitors helps investors assess relative strength and diversification.

It also aids in deciding whether to opt for public sector stability or private sector agility.

Investor Sentiment and Its Impact on SBI Share Price

Investor sentiment is a powerful force that can drive short-term changes in the SBI share price, often independent of fundamentals.

Positive news—like higher earnings, strategic partnerships, or new digital initiatives—can trigger a surge in buying activity.

On the other hand, negative sentiment arising from weak results or policy uncertainty can lead to a sell-off.

Social media, financial news portals, and analyst reports significantly shape how investors feel about SBI’s prospects.

Retail investor participation has also increased in recent years, and their collective behavior often magnifies price movements.

The SBI share price is particularly susceptible to sentiment shifts during periods of market volatility, such as elections or global financial stress.

Although long-term investors focus more on fundamentals, sentiment can’t be ignored as it directly affects supply and demand dynamics.

Understanding how moods and perceptions drive the SBI share price allows investors to take advantage of market psychology in timing their entries or exits.

Is It the Right Time to Buy SBI Shares?

Deciding whether it’s the right time to invest in SBI depends on your financial goals and market outlook.

Analysts often suggest evaluating a stock based on both technical and fundamental indicators before making a move.

Currently, SBI shows strong fundamentals, stable earnings, and consistent dividend payouts, making it attractive for long-term holders.

For short-term traders, the decision may rely more on chart patterns, resistance levels, and market news.

The current valuation of the SBI share price compared to historical averages can offer insights into whether the stock is undervalued or overvalued.

Market conditions also matter; if the broader banking sector is on an upward trend, SBI will likely follow suit.

However, investors should always consider risks such as regulatory changes, rising NPAs, or global economic uncertainty.

Consulting with a financial advisor or doing independent research is crucial.

Ultimately, analyzing the SBI share price in the current context helps determine if it’s the right buying opportunity.

Future Outlook: What to Expect from SBI Share Price in 2025

Looking ahead to 2025, the future of the SBI share price appears optimistic, supported by macroeconomic growth and the bank’s strategic initiatives.

SBI is actively expanding its digital services, improving asset quality, and maintaining a healthy credit portfolio—all of which bode well for long-term performance.

Market analysts forecast a steady rise in stock value if current trends in credit growth and profitability continue.

The expected stabilization of global markets and domestic policy support could further boost the SBI share price in the coming years.

Moreover, SBI’s leadership in retail and corporate banking positions it to benefit from India’s ongoing economic reforms.

Key risks remain, such as inflation or regulatory hurdles, but overall sentiment leans positive.

Investors who are planning for a long-term horizon may find SBI shares a worthy addition to their portfolio.

Keeping a watch on financial results and broader market cues will be crucial in assessing how the SBI share price behaves by 2025.

FAQs

Q1: What is the SBI share price today?

The SBI share price fluctuates throughout market hours and can be checked in real-time on platforms like the NSE (National Stock Exchange), BSE (Bombay Stock Exchange), or trusted financial apps such as Zerodha, Groww, or Moneycontrol.

Q2: Is SBI a good stock to invest in for the long term?

Yes, many analysts consider SBI a strong long-term investment due to its market leadership, consistent performance, and government backing. However, like all stocks, it comes with risks and should be assessed based on your investment goals.

Q3: What factors affect the SBI share price the most?

Key influencers include quarterly earnings, interest rate changes by the RBI, NPAs, loan growth, investor sentiment, and both global and domestic economic events.

Leave a Reply