Indian Bank Share offers a detailed look into Indian Bank’s stock performance, future prospects, and investment potential in 2025.

The guide covers current share price trends, technical and fundamental analysis, dividend history, and expert price predictions up to 2030.

It also explains how to buy shares, compares Indian Bank with other PSU banks, and highlights the key risks and rewards.

Designed for both beginners and seasoned investors.

This guide helps you make informed decisions about investing in Indian Bank shares with practical insights and market-based strategies.

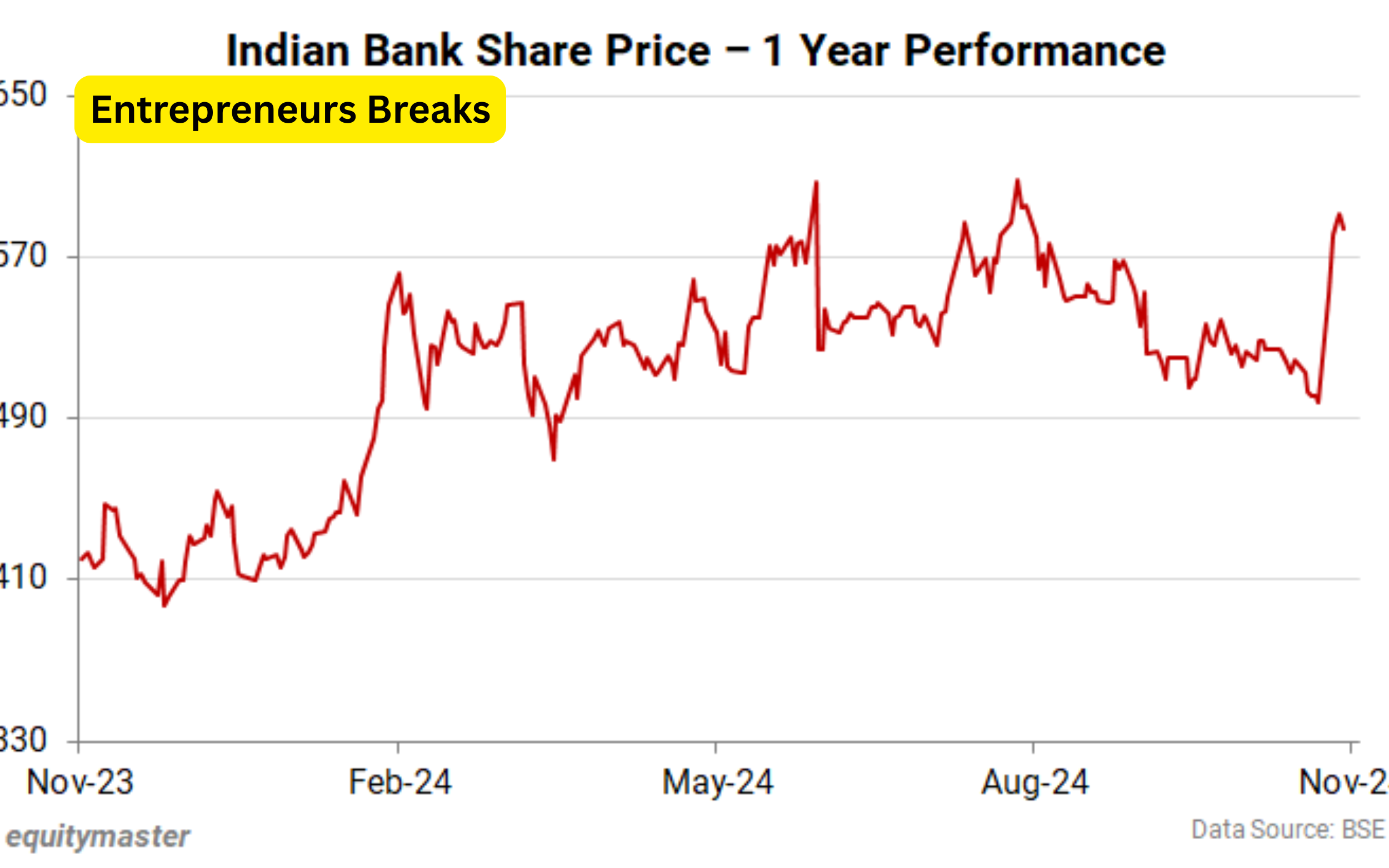

Indian Bank Share Price Today: Live Updates & Market Trends

As of 2025, Indian Bank’s share price reflects the strong recovery and resilience of the Indian banking sector.

The stock is being closely watched by investors due to its consistent performance and government backing.

Live updates of the Indian Bank share price are available on major stock platforms like NSE and BSE.

Where intraday charts and technical indicators offer real-time data.

Monitoring Indian Bank’s price movement daily can help traders make informed decisions and spot entry or exit points. Using platforms like Moneycontrol, NSE India, and TradingView can offer technical tools for better insights.

Is Indian Bank Share a Good Investment in 2025?

Indian Bank In 2025,presents a strong case for long-term investors.

especially those seeking stability and moderate returns from public sector enterprises.

With increasing government initiatives focused on the growth and stability of PSU banks, Indian Bank stands.

As a solid investment option for both conservative and moderately aggressive investors.

However, one must be cautious of sectoral risks, such as interest rate changes, regulatory pressures, and macroeconomic slowdowns.

Like any PSU stock, Indian Bank may not be suitable for high-risk, high-reward portfolios, but for steady growth and income, it holds significant potential.

Investors are advised to review quarterly earnings reports and track management commentary for updated guidance before investing.

Indian Bank Share Analysis: Technical & Fundamental Breakdown

A thorough analysis of Indian Bank shares involves evaluating both technical charts and fundamental financial metrics.

From a technical perspective, Indian Bank stock has shown a steady uptrend in 2025, trading above its 200-day moving average—a bullish signal.

Common technical indicators like the Relative Strength Index (RSI) and MACD suggest moderate momentum, making it an appealing option for short-term trades.

A mix of strong fundamentals and technical stability makes Indian Bank a stock worth tracking regularly for both growth and income investors.

Indian Bank Shareholding Pattern: Who Owns What?

The shareholding pattern of Indian Bank provides useful insights into who controls the bank and how confident institutional and retail investors are in its future.

As of early 2025, the Government of India remains the majority shareholder.

Holding over 70% stake, reinforcing its status as a public sector undertaking (PSU).

Institutional investors, including mutual funds, insurance companies.

And foreign portfolio investors (FPIs), have also shown interest in Indian Bank shares.

Their participation adds credibility and shows confidence in the bank’s growth trajectory and governance practices.

A rise in institutional holdings often signals a bullish outlook.

Retail investors and HNIs (High Net-worth Individuals) form the remaining part of the shareholding base.

The interest from retail investors has grown significantly due to Indian Bank’s relatively low share price and decent dividend yield.

A stable and diversified shareholding pattern often translates to better governance and long-term performance.

Which Indian Bank continues to demonstrate.

Past Performance of Indian Bank Shares: What History Tells Us

Understanding the past performance of Indian Bank shares helps investors get a clearer picture of how the stock behaves under different market conditions.

Over the past decade, Indian Bank has demonstrated periods of both strong growth.

Stagnation, largely influenced by macroeconomic trends, government reforms.

The overall health of the banking sector.

Historically, Indian Bank has been considered a stable, low-beta stock, suitable for conservative investors.

While it may not deliver explosive returns like high-growth private banks.

It has shown resilience and the ability to recover from downturns—an essential trait for long-term portfolio planning.

Indian Bank Share Dividend History and Future Prospects

Indian Bank has maintained a steady record of paying dividends, making it an attractive choice for income-focused investors.

Over the past few years, its dividend yield has remained modest but consistent, reflecting.

The bank’s balanced approach between rewarding shareholders and retaining earnings for growth.

For long-term investors, Indian Bank offers a good mix of capital appreciation and dividend income.

However, it’s essential to track quarterly results and dividend declarations to stay informed.

If profitability continues its upward trend, there is potential for enhanced shareholder returns in the coming years.

How to Buy Indian Bank Shares: A Beginner’s Guide

Buying Indian Bank shares is a straightforward process, especially for beginners looking to enter the stock market.

First, you’ll need to open a Demat account and trading account with a SEBI-registered.

Stockbroker like Zerodha, Upstox, Groww, or traditional firms like ICICI Direct and HDFC Securities.

Additionally, using mobile apps for tracking performance, setting alerts.

Reading market news can enhance your trading experience.

Indian Bank shares, being listed on both NSE and BSE, are easily accessible to all investors.

Indian Bank Share Price Target 2025-2030: Expert Predictions

Predicting the future price of Indian Bank shares involves analyzing both macroeconomic factors and the bank’s internal performance.

Analysts generally provide short-term (1 year), medium-term (3 years).

Long-term (5–6 years) price targets based on earnings growth, book value, and expected return on equity (ROE).

Key drivers for growth include:

- Expansion in retail and MSME lending

- Focus on digital banking

- Better credit monitoring systems

- Higher CASA ratio (Current and Savings Account deposits)

Risks to these targets include economic slowdowns, inflationary pressures, or global events impacting the banking sector.

Investors should treat these targets as estimates, not guarantees.

Regular updates from quarterly results, management guidance.

Government policy changes can lead to revisions.

A diversified approach and long-term holding can help ride out short-term volatility while aiming for these targets.

Indian Bank vs Other PSU Banks: Which Share is Better?

When comparing Indian Bank with other public sector banks like Bank of Baroda, Punjab National Bank, and Canara Bank, a few factors stand out.

Indian Bank often ranks higher in terms of asset quality and efficiency ratios.

Its capital adequacy, loan book strength, and relatively low NPA levels make it a more balanced performer in the PSU space.

Ultimately, choosing between Indian Bank and other PSU banks depends on your risk tolerance and investment goals.

If you’re looking for a balanced, low-risk PSU bank with decent growth potential and stability, Indian Bank remains one of the top contenders.

Risks and Rewards of Investing in Indian Bank Shares

Like any equity investment, Indian Bank shares come with a mix of risks and rewards.

On the reward side, investors benefit from stable performance, consistent dividend income.

Long-term capital appreciation, particularly with government support and a clear growth roadmap in place.

However, several risks need to be considered. These include:

- Rising interest rates that can squeeze margins

- Economic slowdown or inflation that may impact loan growth

- Regulatory changes or government intervention

- Asset quality risks due to defaults in the retail or MSME segments

Indian Bank, as a PSU, may also face challenges related to bureaucratic decision-making, slower tech adoption (compared to private peers), and limited pricing power.

Despite these concerns, Indian Bank has shown resilience and operational improvement, especially post-merger.

With strong fundamentals, investor-friendly policies, and digital transformation underway.

The rewards can outweigh the risks for long-term investors who enter at the right valuation.

To manage risk, investors should monitor quarterly performance, diversify their portfolio.

Have a long-term investment horizon.

FAQs

- What is the current price of Indian Bank shares?

The price of Indian Bank shares fluctuates regularly based on market conditions. For real-time updates, check platforms like NSE, BSE, or financial news websites. - Is Indian Bank a good stock to invest in for 2025?

Yes, Indian Bank offers stable growth with strong fundamentals, making it a good investment for conservative and long-term investors, although short-term fluctuations may occur. - What is the dividend yield for Indian Bank shares?

Indian Bank’s dividend yield has been around 2-3% in recent years. This is subject to change based on profitability and regulatory guidelines. - How can I buy Indian Bank shares?

You can buy Indian Bank shares by opening a Demat and trading account with a SEBI-registered broker. Then, place an order through their platform. - What are the risks of investing in Indian Bank shares?

Risks include economic slowdowns, interest rate hikes, and regulatory changes, but the bank’s strong fundamentals and government backing help mitigate some of these risks. - What is the price target for Indian Bank shares in 2025-2030?

Analysts predict a price target of ₹400 to ₹470 for 2025 and ₹550 to ₹700 by 2030, assuming continued growth and strong fundamentals.

Leave a Reply